In this case study, the SME Team addresses a bank's fraud analysis need by utilizing Azure Data Factory and Snowflake to engineer a solution that improved their time to insight for potential fraud.

Fraud analytics is one of the 3 top big data use cases in financial services.

XYZ Bank processes about 60 million transactions a day and they need to continuously integrate the new data with historical data, consisting of about 5 billion rows of transactions every 90 days. In order to better predict credit/debit card fraud, analysis must be done on this massive amount of data. The below contains the challenges, goals, initiatives, and impacts for the fraud analytics case study.

THE CHALLENGES

With the exponential growth in digital transactions, XYZ Bank is grappling with the monumental task of efficiently handling and making sense of the vast sea of over 5 billion credit and debit card transaction records stored in their transactional database. The sheer volume of data presents a significant challenge in terms of processing, analyzing, and extracting valuable insights to combat fraud effectively.

In order to effectively manage the vast amount of transactional data, XYZ Bank must seamlessly integrate it into their data warehouse for real-time analysis while also securely archiving it in the data lake for future reference. This dual approach ensures that the historical transaction records are readily accessible for in-depth analysis and compliance purposes, while the data warehouse enables quick and efficient querying for immediate insights into potential fraudulent activities. By implementing this integrated data storage strategy, XYZ Bank can harness the power of both structured and unstructured data to enhance their fraud detection capabilities and stay ahead of emerging threats in the financial services industry.

Utilizing Power BI for analysis proves challenging as direct connection to the entire dataset is hindered by limitations. Loading the data into the report hits the memory threshold, causing reload failures. Additionally, utilizing direct query necessitates a larger warehouse, leading to significant cost escalation if used consistently throughout the day.

To overcome these challenges, XYZ Bank had to find advanced data solutions to optimize their data visualization process. They had to explore alternative methods of data loading and querying to ensure smooth and efficient analysis without compromising on performance or incurring unnecessary costs.

THE GOAL

The bank collaborated with SME to design a solution aimed at harnessing 3 months of data for a more precise identification of potential fraudulent transactions. By leveraging advanced analytics and cutting-edge technology, the goal was to not only detect fraud but also transition towards predictive fraud detection scenarios. This strategic partnership paved the way for enhanced accuracy and efficiency in identifying and combating fraudulent activities within XYZ Bank's vast transactional database.

Moreover, the overarching objective was to elevate the overall performance, speed, and dependability of analytical reports. By seamlessly connecting to carefully curated data marts, the bank aimed to streamline the process of extracting actionable insights and valuable information from their data. This approach ensured that decision-makers had access to real-time, relevant data to make informed decisions and stay ahead of potential threats in the ever-evolving landscape of financial fraud.

Through this collaboration, XYZ Bank was able to not only meet but exceed their goals, setting new benchmarks for fraud detection and prevention within the industry. The integration of innovative technology and expert analysis led to a significant improvement in the bank's ability to proactively identify and address fraudulent activities, ultimately resulting in a more secure and resilient financial ecosystem.

KEY INITIATIVES

In order to provide a solution that met the bank's goals, SME assessed their current data ecosystem. From the assessment, a plan was constructed and implemented. These were the key steps our technical team performed for XYZ Bank:

- Use Azure Data Factory to move data from the transactional database, Azure SQL, to Azure Data Lake Storage

- Use Azure Data Factory to partition the data, store in the data lake, and load into Snowflake

- Perform complex data transformations within Snowflake to prepare a data mart for analysis

- Direct query the transformed data mart inside Snowflake with Power BI

BUSINESS IMPACT

Upon implementing the solution, it became evident that the set goals were not only achieved but surpassed, resulting in tangible business outcomes:

- Discovering actionable insights by visualizing anomalies in the data

- Narrowing down from a staggering 5 billion records to pinpointing specific accounts with unusual spending patterns

- Significant reduction in analytical warehousing expenses

- Enhanced efficiency in gaining valuable insights in record time

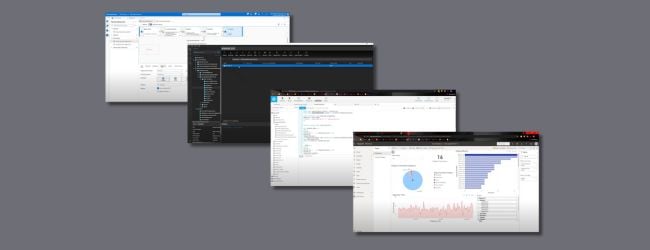

SEE IT IN ACTION

SME's George Barrett was the lead Solutions Engineer on the project. After scrubbing and anonymizing the data, he led a webinar that went into detail on this case study and includes an end-to-end demo of “5 Billion to 1: Data Engineering for Fraud Analysis”.

.png?width=700&height=127&name=Blue%20Mantis%20formerly%20known%20as%20SME%20Solutions%20Group%2c%20Inc.%20(GREEN).png)

.jpg?width=400&height=311&name=5%20Billion%20to%201%20Data%20Engineering%20for%20Fraud%20Analysis%20(2).jpg)